They call Economics "the dismal science". If you've ever taken a basic econ class, you'll know why. The assumptions upon which economics are built are known to be faulty (people do not act "rationally" as defined by economists), the conclusions are often depressing, many of the important questions are left unasked, and the ability of economists to agree on how the world works (or an economy works) is extremely limited. These problems notwithstanding, we spend an appalling amount of time thinking about the economy, worrying about the economy, trying to effect the economy, trying to predict the economy, and generally obsessed with the economy.

So let's take a look at a few current "conditions"

Pricing the War

Joseph Stiglitz and Linda Bilmes suggest that the Iraq War is going to cost $3 trillion or even more. You can see the current direct costs of the war for the US, states, towns, or congressional districts at the National Priorities Project.

The Economist weighs in, largely with quotes from others, so I won't quote it. But check out this blog entry by Robert Reich.

- Amount requested by the Bush Administration for 2008 War Funding: $196,400,000,000 (that's $196.4 billion)

- Number of households in the US: 126,316,181 (that's 126 million)

- Annual Cost per Household: $196,400,000,000 / 126,316,181 = $1554.83

- Monthly Cost per Household: $1554.83 / 12 = $129.57

That $1550 annual cost is the whole War on Terror, not just the Iraq War. What could you do with $1550 in your household? Of course, it's not evenly distributed. People who pay more taxes bear more of the direct cost.

But we all bear the secondary costs, like current and future interest expense for the money we're borrowing to pursue the war. We also all bear the opportunity cost. According to the National Priorities Project site, taxpayers in the state of Washington (my nearest US neighbor) will spend $1.9 billion for Iraq War funding in FY 2008. That money could have bought:

- health care for 300,000 people

- health care for 767,000 children

- Head Start for 214,000 children

- 35,000 public safety officers

- 30,000 music & art teachers

- 31,000 elementary school teachers

- 317,000 scholarships to university

- 179 elementary schools

- 25,000 port inspectors for shipping containers

- 10,000 affordable housing units

In FY 2009, projected spending for the taxpayers of Washington state will be $3.2 billion (168% of the FY 2008 spending.

According to Zachary Coile of the Chronicle:

In historical perspective, the Iraq conflict is already one of the most expensive conflicts in U.S. history.

The price tag in Iraq now is more than double the cost of the Korean War and a third more expensive than the Vietnam War, which lasted 12 years. Stiglitz and Bilmes calculate that it will be at least 10 times as costly as the 1991 Gulf War and twice the cost of World War I.

Only World War II was more expensive. That four-year war - in which 16 million U.S. troops were deployed on two fronts, fighting against Germany and Japan - cost about $5 trillion in inflation-adjusted dollars.

In early 2003, White House Office of Management and Budget Director Mitch Daniels said a war with Iraq could cost $50 billion to $60 billion. Even Congressional Democrats suggested it would cost only $93 billion (although they specifically excluded peacekeeping costs).

The Economist article linked above is quick to note that "suggestions that the war is responsible for current economic malaise are misguided--to the contrary, given under-utilised capacity, the war is probably helping to keep the economy moving". Their contention is that we're not using our full production capacity because of current problems with the dollar and demand and the credit crunch and so keeping the machines operating by having a war is reducing our economic problems. IF that is correct, and I doubt it is, surely we could do at least as well by spending that money here in the US, perhaps fixing some of the crumbling infrastructure in which Republicans don't believe we should invest money.

Home Foreclosures

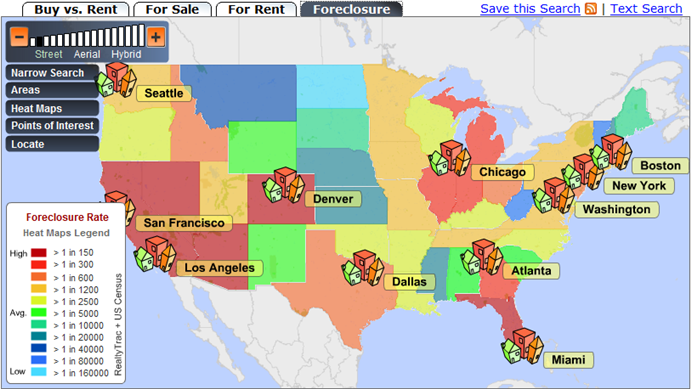

California, Nevada, Colorado, and Florida are experiencing foreclosure rates of more than 1 in 150. If you click through to the zoomable map, you can examine your region, or downtown Tampa, or wherever. Some neighborhoods are getting very hard hit. Absolutely great map.

During the peak of the Great Depression (1932-33), foreclosure rates reached roughly 10% (pdf). That's 10% of all mortgages, not 10% of all houses. Our current rate is about 1% of all households. About 1.3 million homes entered foreclosure in 2007, with 1 to 2 million households predicted to face foreclosure in the next 18 months or so. The US home-loan market was about $3 trillion in 2006. About 1 million new single family homes were sold in 2006. The average house sold in 2006 cost $305,000. If all houses were fully financed (not likely), $3 trillion / $300,000 = 10,000,000 houses sold in 2006. If 1.3 million homes entered foreclosure in 2007, that's equal to 13% of the houses sold in 2006. If half of all home purchase costs were financed, then $3 trillion / $150,000 = 20,000,000 houses sold in 2006 and 1.3 million foreclosures represents about 6.5% of the houses sold in 2006. Without better data I can't get more precise, but we appear to be below the 10% foreclosure rates of the Great Depression, but within an order of magnitude and possibly in the vicinity of half of those rates. Too close for my comfort, certainly.

Real Wages

Real wages are down for this generation of adult Americans. Taking men in their 30s as a generational proxy, real wages are 12% less than in 1974. According to the EMP American Dream Report, released in May 2007 (WSJ article quoted here, gated version here):

Beginning with a comparison of men ages 30-39 in 1994 with their fathers' generation, men ages 30-39 in 1964, we see a small, but fairly insignificant, amount of intergenerational progress...Adjusting for inflation, median income increased by less than $2000 between 1964 and 1994, from about $31,000 to under $33,000 -- a 5 percent increase (0.2 percent per year) during this thirty-year period.

The story changes for a younger cohort. Those in their thirties in 2004 had a median income of about $35,000 a year. Men in their fathers’ cohort, those who are now in their sixties, had a median income of about $40,000 when they were the same age in 1974. Indeed, there has been no progress at all for the youngest generation. As a group, they have on average 12 percent less income than their fathers’ generation at the same age.

Bottom line, our condition ain't everything it should be. It's pretty clear that the experiment in relatively unbridled capitalism over the last 30 years or so has failed many Americans. It's time for change.

|